All Categories

Featured

State Ranch agents sell whatever from property owners to vehicle, life, and various other prominent insurance coverage items. So it's easy for agents to bundle services for price cuts and easy plan management. Many consumers delight in having one trusted agent take care of all their insurance coverage needs. State Farm offers global, survivorship, and joint universal life insurance plans.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

State Farm life insurance policy is generally traditional, using secure options for the typical American family members. Nonetheless, if you're trying to find the wealth-building possibilities of universal life, State Farm lacks competitive choices. Read our State Ranch Life insurance policy evaluation. Nationwide Life Insurance Policy sells all types of universal life insurance policy: universal, variable universal, indexed universal, and universal survivorship plans.

However it doesn't have a solid visibility in various other financial products (like universal plans that unlock for wealth-building). Still, Nationwide life insurance strategies are highly accessible to American family members. The application process can additionally be more manageable. It assists interested events get their means of access with a reputable life insurance policy strategy without the far more complex discussions about financial investments, monetary indices, etc.

Nationwide fills up the vital function of obtaining reluctant buyers in the door. Even if the most awful takes place and you can not obtain a bigger strategy, having the security of an Across the country life insurance policy policy can change a customer's end-of-life experience. Read our Nationwide Life insurance policy review. Insurer make use of clinical tests to evaluate your danger course when looking for life insurance policy.

Buyers have the alternative to alter rates each month based on life situations. A MassMutual life insurance policy agent or economic consultant can aid buyers make plans with area for modifications to satisfy temporary and lasting financial objectives.

Adjustable Life Insurance Policy

Some purchasers may be surprised that it offers its life insurance policies to the general public. Still, army participants delight in one-of-a-kind benefits. Your USAA policy comes with a Life Event Choice rider.

If your policy doesn't have a no-lapse assurance, you may also shed protection if your cash value dips listed below a certain threshold. It may not be a terrific option for individuals who simply desire a death benefit.

There's a handful of metrics by which you can judge an insurance provider. The J.D. Power customer satisfaction rating is a great choice if you desire an idea of exactly how consumers like their insurance coverage. AM Finest's monetary stamina ranking is another vital metric to consider when selecting a global life insurance coverage business.

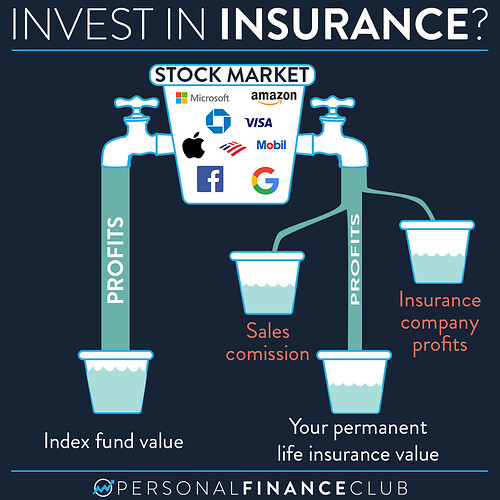

This is specifically vital, as your cash money value expands based upon the investment choices that an insurance policy firm provides. You ought to see what investment options your insurance coverage supplier offers and compare it versus the objectives you have for your plan. The very best way to find life insurance coverage is to collect quotes from as numerous life insurance policy firms as you can to recognize what you'll pay with each policy.

Latest Posts

What Is Equity Indexed Universal Life Insurance

Universal Aseguranza

Universal Life 保险